reit tax benefits uk

Income profits and capital gains of the qualifying property rental business of the REIT are exempt from corporation tax. Assuming a 5 distribution and a 40-year depreciable life depreciation would amount to 25 annually.

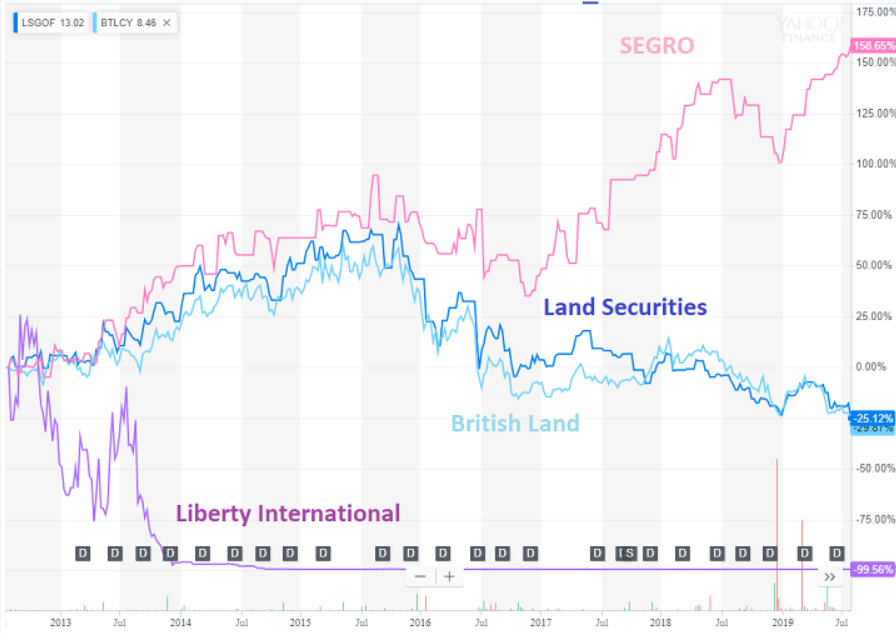

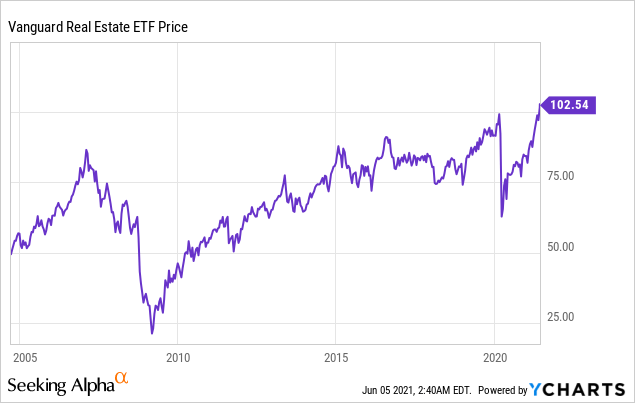

It S Tea Time Our Top Growth And Income Reits In The U K Otcmkts Btlcy Seeking Alpha

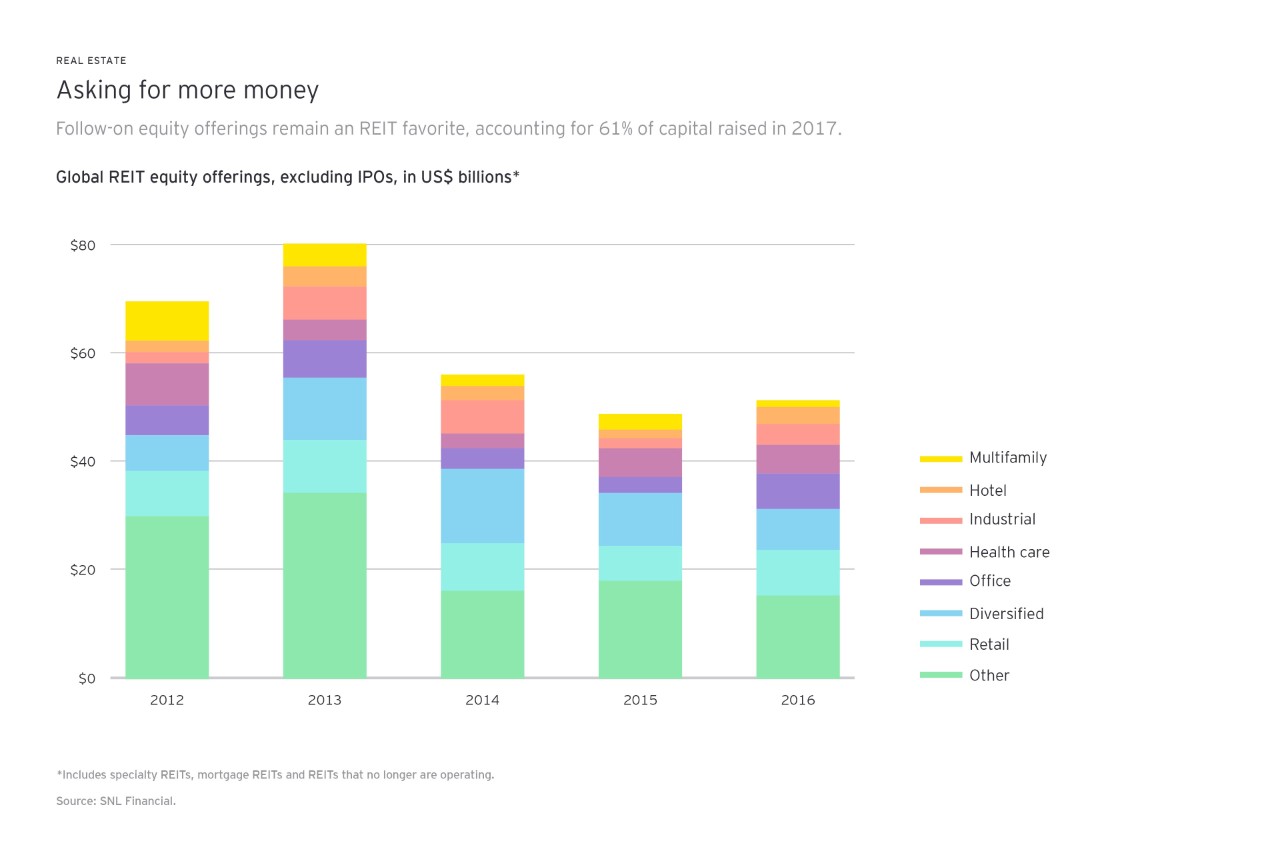

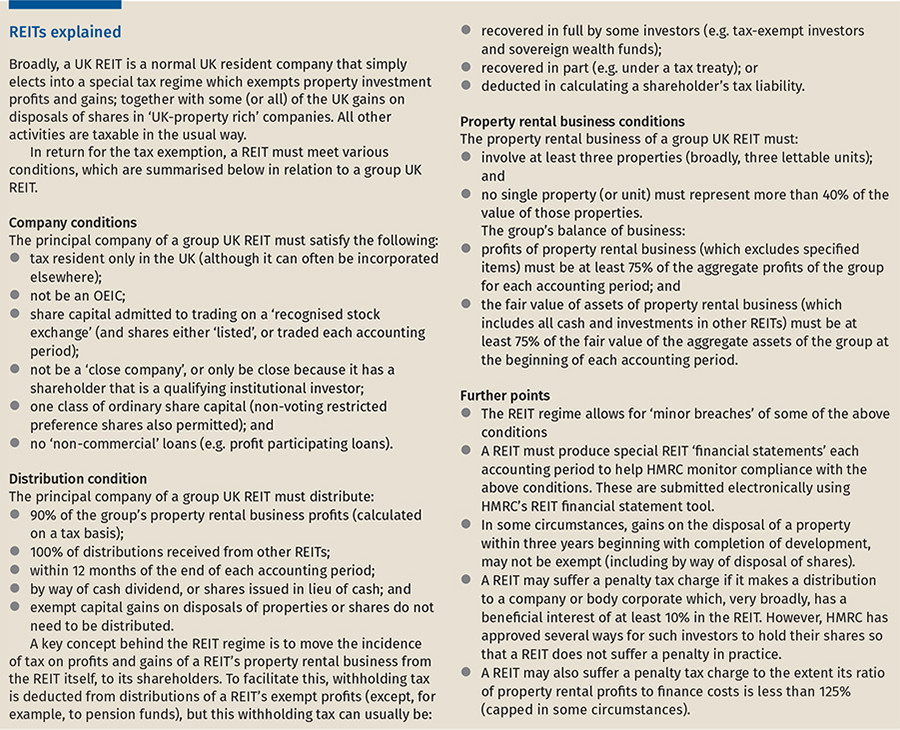

The main rules for.

. It offers exposure to a portfolio of Urban and Big box warehouses in Europe with a combined value of 184b. Investors in the 10 or 15 tax brackets pay no long-term capital gains taxes while those in all but the highest income bracket will pay 15. The election exempts a REIT from paying corporation tax on its qualifying.

Births death marriages and care. 20 withholding tax is. Advantage 3 - Tax Efficiencies.

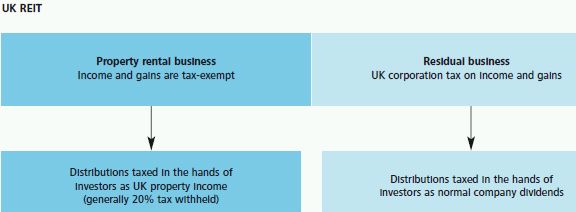

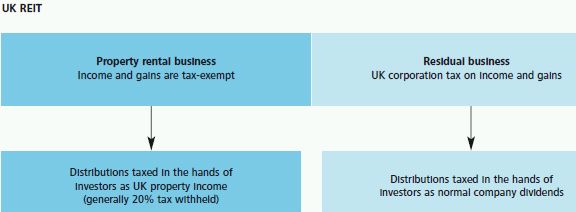

Real estate trusts are a different animal from typical corporations. With negative real bond yields here is how you can invest for passive income right now. A Real Estate Investment Trust REIT is exempt from UK tax on the income and gains of its property rental business.

A REIT investor REIT can now invest in another REIT target REIT without a tax penalty so long as the investor REIT distributes to its shareholders the whole of the rental distribution received from the target REIT. The largest UK REIT is Segro SGRO with a market cap of 124b. The 60 ROC scenario reflects the following.

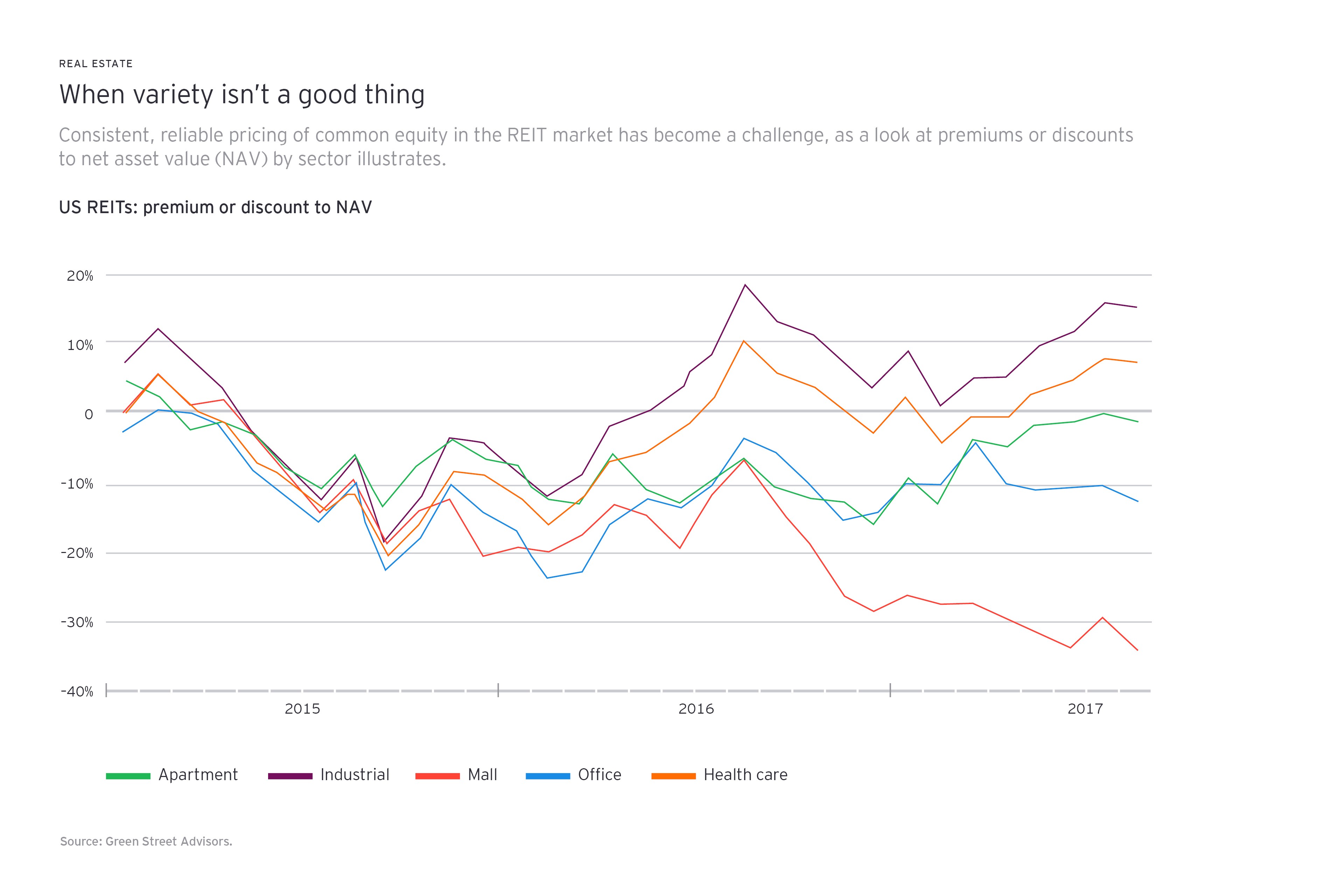

This means that for a shareholder in a UK-REIT the tax impact is similar to direct investment in real estate. Subject to a number of conditions a UK real estate investment trust REIT is a company or a group of companies with a parent company that has elected to be a REIT under the UK tax legislation. Depreciation and Return of Capital.

Wish You Could Invest in the Lucrative Real Estate Market. For UK resident individuals who receive tax returns the PID from a UK REIT is included on the tax return as Other Income. This relaxation will provide a further vehicle for joint ventures with the benefit of liquidity and the additional flexibility.

Using a UK-REIT means there is no direct tax. REITs are similar in many ways to collective fund vehicles such as unit trusts in that they allow investors to pool their resources so as to provide them with opportunities which might not. Segro has a history of paying dividends and has increased its dividend payout since 2017 while keeping its payout ratio conservative.

After tax return from UK company After tax return from UK REIT Enhancement of return UK pension fundsISAs SIPPs and sovereign wealth funds 75 100 333 Overseas investor beneficial tax treaty75 85 133 UK individual basic rate 20 tax payer 69 80 158 UK individual higher rate 40 tax payer 51 60 185 UK individual additional rate. If the REIT held the property for more than one year long-term capital gains rates apply. These REITs are Under 49.

Ad 5 Reasons Why We Think You Should Get Into Real Estate Investment Trusts. After tax return from UK company After tax return from UK REIT Enhancement of return UK pension fundsISAs SIPPs and Sovereign wealth funds 75 100 333 Overseas investor. REIT Tax Benefits No.

It also enables exempt investors to benefit from their own tax status. Distributions of income profits and capital gains by the REIT are treated as income from a property rental business in the hands of investors. The benefits are considerable.

If completing the return online in the section Other UK Income tick the bottom box Any other income. Including additional non-cash deductions we estimate that 60 of distributions would be considered ROC. An overview of the tax structure of REITs and the applicable conditions.

In my latest featured guide to REITs UK you can find out what a Real Estate Investment Trust is how it works and the various benefits and disadvantages of investing in them. A UK-REIT is exempt from UK corporation tax on profits both income profits and capital gains arising from carrying on a qualifying property rental business. But REITs do not pay any Corporation Tax.

A normal UK company is required to pay Corporation Tax on profits at a rate of 19. Ad Looking for a non-traded REIT. The REIT is exempt from UK tax on the income and gains of its property rental business.

Build a private real estate portfolio with C-REIT. Of all the different asset classes investing in property is one of the most popular strategies in the UK for generating an extra source of income. Corporation Tax is payable on its profits and gains from any other activities.

This corporation tax is paid by the company before any dividends are paid out to investors. REITs benefit from some pretty special tax advantages. C-REIT makes building a commercial real estate portfolio easy with just one investment.

Straight-line depreciation can account for approximately 50 of a REITs distributions. Shareholders who fall into the highest income tax bracket currently 37 will pay 20 for long-term capital gains. Ad Learn the basics of REITs before you invest any.

Ad This company is required by law to distribute 90 of its taxable income to shareholders. The main tax implications of electing for REIT status are. On the next page enter the total amount of the PID received including tax in Other taxable income before.

A real estate investment trust REIT is in fact not a trust at all it is a company which qualifies for special tax treatment under CTA 2010 Part 12. A real estate investment trust REIT is a property investment company which very broadly simulates from a tax perspective direct investment in UK property and so avoids the additional layer of taxes that can arise when investing through a corporate structure.

A Short Lesson On Reit Taxation

How Reit Regimes Are Doing In 2018 Ey Slovakia

Reits Vs Real Estate Mutual Funds What S The Difference

10 Years Of Uk Reits From Bad Timing To Better Times S P Global Market Intelligence

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

Conversable Economist What Should Be Included In Income Inequality Income Inequality C Corporation

We Often Get The Question What Makes A Fundrise Ereit Worth Investing In Over The Vanguard Reit Etf Here We Investing Best Investments Investment Companies

How To Invest In Reits In The Uk Raisin Uk

Very Bad News For Reit Investors Seeking Alpha

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

How Income Tax Rules Help Reit Investors Earn More In Long Term Mint

Taxation Of Reits Ringing In The Changes

Uk Reits A Summary Of The Regime Fund Management Reits Uk

Reit Dividends And Uk Tax Assura

A Short Lesson On Reit Taxation

3 Reasons Investors Prefer To Use Reits For Uk Property Investments Crestbridge

/AreREITsBeneficialDuringaHigh-InterestEra4-dbc06be2b2644060acc3bf1f7fe7aa37.png)